Table of Contents

As we stand at the crossroads of technological evolution, cryptocurrency has emerged as a powerful force reshaping our financial landscape. Market fluctuations, regulatory advancements, and evolving consumer behaviors are merely the tip of the iceberg in this dynamic arena. With every innovation, there lies an opportunity—one that beckons investors, technologists, and enthusiasts alike to delve deeper into the nuances of this digital frontier.

The cryptocurrency space is not just about speculative investments; it reflects broader social and economic trends. Decentralization, blockchain technology, and the growing acceptance of digital assets are redefining traditional paradigms, prompting us to reconsider our established notions of value and trust. As we explore these transformative trends, the potential for a more democratized financial system comes into clearer view, urging both caution and curiosity.

In a world increasingly dominated by technology, understanding these trends will be essential for anyone seeking to navigate the complexities of crypto. Whether it’s the rise of decentralized finance (DeFi), the quest for digital identity solutions, or the influence of Central Bank Digital Currencies (CBDCs), the future of cryptocurrency is unfolding in ways that are both unpredictable and exciting. Join us as we unlock the key trends shaping this ever-evolving landscape and consider how they may impact the world at large.

Navigating the Evolving Regulatory Landscape in Cryptocurrency

As cryptocurrency continues to gain traction globally, the regulatory landscape is in a constant state of flux, posing both challenges and opportunities. Key players, including governments and financial institutions, are reevaluating existing frameworks, which can lead to a more organized market but may also stifle innovation if overly restrictive. Stakeholders must stay informed about potential changes to compliance requirements to ensure they swiftly adapt to new regulations that can shape the future of their investments.

Critical areas of focus in this evolving terrain include taxation policies, anti-money laundering (AML) requirements, and consumer protection laws. Companies operating in the cryptocurrency space must enhance their transparency and establish robust risk management practices. embracing a proactive approach towards regulation can not only mitigate risks but also catalyze growth, fostering a more stable environment for digital assets.

| Regulatory Focus | Impact |

|---|---|

| Taxation Policies | Increased clarity on tax obligations, enhancing compliance. |

| AML Requirements | Strengthened measures to prevent illicit activities, boosting trust. |

| Consumer Protection | Improved safeguards for investors, promoting market integrity. |

Harnessing the Power of Decentralized Finance for Financial Inclusion

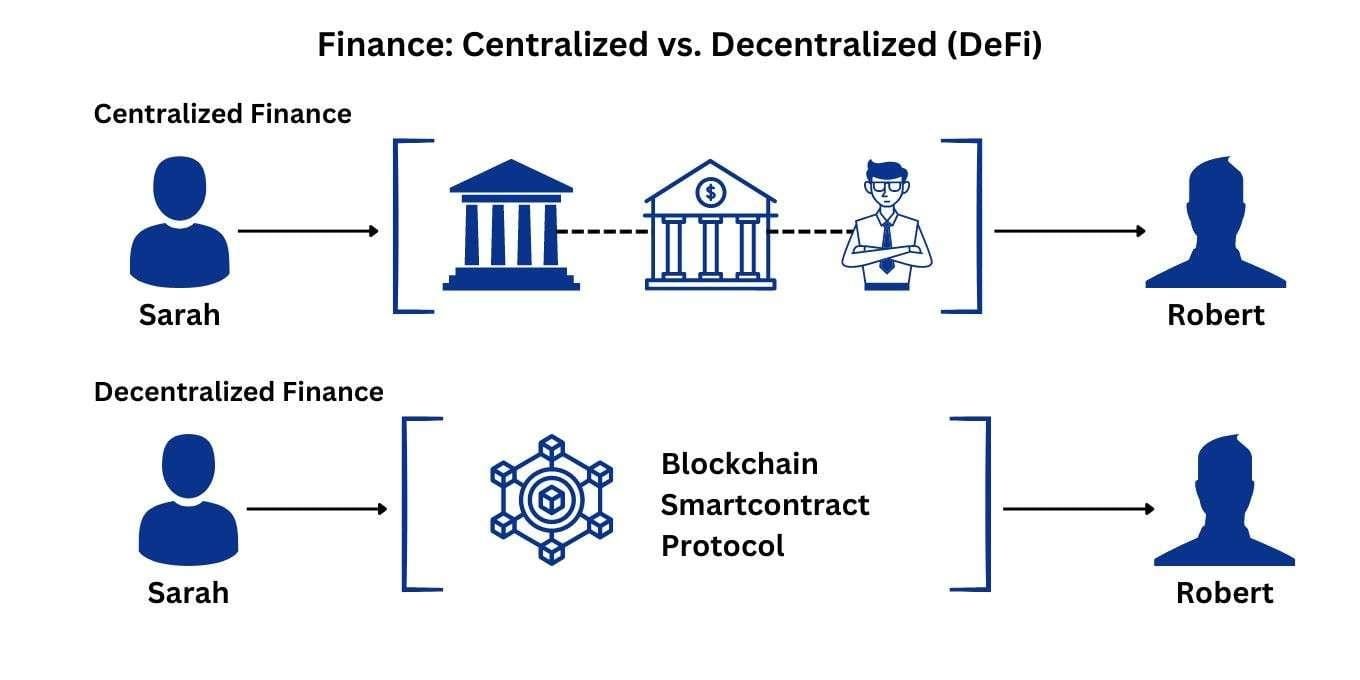

Decentralized finance (DeFi) is revolutionizing traditional banking by providing access to financial services for those who are often excluded from the system. Utilizing blockchain technology, DeFi eliminates intermediaries, allowing individuals to engage in transactions seamlessly and securely. Key benefits include:

- Lower costs: By cutting out middlemen, users save on fees.

- Increased accessibility: Services are available to anyone with internet access.

- Empowerment: Users gain control over their assets without reliance on institutions.

As DeFi continues to grow, the impact on global financial inclusion becomes evident. Innovative platforms are emerging that address the unique needs of underserved populations, such as micro-lending and insurance. A glimpse into the potential of this transformation:

| DeFi Solutions | Target Audience | Impact |

|---|---|---|

| Micro-lending | Small business owners | Boosts local economies |

| Decentralized insurance | Farmers in developing regions | Mitigates risks from natural disasters |

Emerging Technologies Driving Innovation in Blockchain Solutions

Innovative breakthroughs are reshaping the blockchain landscape, paving the way for enhanced security and scalability. Decentralized Finance (DeFi) is one of the most transformative trends, enabling users to engage in financial transactions without intermediaries. Interoperability solutions are also gaining momentum, allowing different blockchain networks to communicate and share data seamlessly, thus unlocking new potentials for cross-chain applications.

Moreover, the rise of layer-two scaling solutions is addressing the challenges of transaction speed and fees, fostering a more user-friendly environment. Smart contracts continue to evolve, with new programming languages enhancing their functionality and security. The convergence of emerging technologies, such as AI and IoT, is set to further amplify the capabilities of blockchain, establishing a synergistic ecosystem for ground-breaking innovations.

| Technology | Impact |

|---|---|

| Decentralized Finance (DeFi) | Redefines financial transactions by removing intermediaries |

| Interoperability | Facilitates seamless interaction among blockchains |

| Layer-Two Solutions | Enhances transaction speed and reduces costs |

| Smart Contracts | Improves functionality and security with new languages |

| AI and IoT | Creates a synergistic environment for innovations |

Building Trust and Security in the Age of Digital Assets

In an era where digital assets are becoming mainstream, the importance of trust and security can’t be overstated. As more individuals and institutions adopt cryptocurrencies, it is essential to have robust frameworks in place to foster confidence. Ensuring transparent operations, decentralized validation, and immutable ledgers are foundational elements that can help cultivate a secure environment. Moreover, deploying proven technologies like blockchain encryption significantly reduces vulnerabilities.

To establish a dependable ecosystem, stakeholders must focus on user-friendly solutions that emphasize security. Initiatives such as multi-signature wallets, two-factor authentication, and smart contract audits play critical roles in enhancing protection. Here are key aspects to consider:

- Education: Raising awareness about safe practices.

- Compliance: Adhering to regulations to build legitimacy.

- Community Engagement: Involving users in governance and feedback loops.

As more players enter the arena, a collective effort will be necessary. Collaborations between tech innovators and security experts can curate standards that everyone can trust. By prioritizing these elements, the digital asset landscape can evolve into a safer and more inclusive environment.

| Aspect | Importance |

|---|---|

| Transparency | Builds user confidence |

| Regulation | Promotes industry credibility |

| Education | Informs safe practices |

Insights and Conclusions

As we stand on the precipice of a new digital frontier, the future of cryptocurrency is not just about transactions, but about transformation. Understanding the trends currently shaping this evolving landscape is crucial for anyone looking to navigate the complexities of the crypto world.

Key trends include:

- Blockchain innovation: Facilitating smarter contracts and decentralized finance.

- Regulatory advancements: Ensuring safer trading environments and consumer protections.

- Sustainability efforts: Addressing the environmental impact of mining practices.

These elements together paint a picture of a vibrant ecosystem thriving on resilience and adaptability.

Embracing these shifts can empower investors and enthusiasts alike to make informed decisions. As we continue to explore and adapt, collaboration and community engagement will play pivotal roles in steering crypto toward a more inclusive and robust future.

staying attuned to these trends will not only unlock potential opportunities but will also pave the way for a more secure, sustainable, and dynamic digital economy. As we venture into what’s next, remember that the key to success in this ever-evolving narrative lies in awareness and adaptability.